Water Plants:

The District has three water plants: Water Plant No. 1 (constructed in 1968), Water Plant No. 2 (constructed in 1989), and Water Plant No. 3 (constructed in 2020). The District had four water wells but abandoned Water Well No. 1 in 2023. The District now has one water well remaining at each plant site. Proposed Capital Improvements Plan (“CIP”) projects over the next 10 years include rehabilitation of tanks and piping (such as recoating to prolong the useful life and prevent corrosion); replacement of three hydropneumatic tanks constructed approximately 30 years ago (at the time of replacement); replacement of the control building at Water Plant No. 1 (constructed in 1968); replacement of Water Well No. 2 (constructed in 1972); and other rehabilitation and maintenance items.

Water Distribution System:

The District owns and maintains up to 33 miles of water distribution lines ranging from 4-inch (4”) to 12-inch (12”). Approximately 15 miles of the distribution system was constructed between 1967 through 1985 using primarily concrete waterline piping. Proposed Capital Improvements Plan (“CIP”) projects over the next 10 years include several phases of construction to begin replacement of the oldest sections of the waterline distribution system.

Wastewater Treatment Plants:

The District has two wastewater treatment plants (“WWTP”) under a single Texas Pollutants Discharge Elimination Systems (“TPDES”) Permit. The WWTPs are permitted to flow at a maximum of 1,400,000 gallons per day (“gpd”). The District currently flows at approximately 830,000 gpd, or 60% of our permitted flow. WWTP No. 1 was originally constructed in 1967, and WWTP No. 2 was constructed in 2014. The District owns and operates the WWTPs, but shares in ownership with Oakmont PUD, who owns 25.71% of the facility (including all maintenance and operations expenses at both WWTP Nos. 1 & 2).

Proposed Capital Improvements Plan (“CIP”) projects at WWTP No. 1 include: recommissioning of Clarifier No. 1 which has been offline for several years due to required repairs (replacement of pumps, clarifier drive, skimmer mechanism, trough, electrical equipment, piping, etc.); rehabilitation to the concrete basins (constructed in various phases between 1967 and 2008); replacement of equipment (i.e. pumps, piping, blowers, generator, control panels, diffusers, etc.); floodplain mitigation to raise electrical equipment and basins walls above the floodplain elevations as required by Harris County; and other general rehabilitation and maintenance (such as renewals of TPDES permits).

Per TCEQ requirements, if a WWTP exceeds 75% of its permitted flow for three consecutive months, the District needs to begin planning for a WWTP expansion. If a WWTP exceeds 90% of its permitted flow for three consecutive months, the District should be entering construction of an expansion.

Based on the current flow plus estimated projected additional flow from properties within the District, the District will exceed 90% of their permitted flow upon full development of the District. Proposed Capital Improvements Plan (“CIP”) projects at WWTP No. 2 include upgrading of the plant to 1,850,000 gpd to meet current plus estimated projections within the District; and other rehabilitation and replacement of equipment (i.e. pumps, piping, blowers, generator, control panels, diffusers, etc.) in the original plant (constructed in 2014).

Sanitary Sewer Collection System:

The District owns and maintains up to 33 miles of sanitary sewer collection system ranging from 6-inch (6”) to 24-inch (24”). The District recently began investigating an inflow and infiltration (I&I) of storm water into the sanitary sewer system. Excessive I&I in the sanitary sewer system can lead to a violation of the District’s wastewater treatment plant discharge permit (issued by the TCEQ) during large rain events. The District completed an initial phase of sanitary sewer rehabilitation in 2010; and recently televised a portion of the sanitary sewer system. In 2023, the District also performed an I&I study and smoke testing to locate areas in the sanitary sewer system which receive high amounts of I&I. Proposed Capital Improvements Plan (“CIP”) projects over the next 10 years include several phases of sanitary sewer rehabilitation (such as full epoxy coating of manholes and cured-in-place piping the sanitary sewer line segments) to renew the collection system and reduce the I&I into the collection system.

Sanitary Sewer Lift Stations:

The District has 7 offsite sanitary sewer lift stations, which collect the sewage from the gravity sanitary sewer collection system and pumps the sewage either to the WWTP or further down the collection system. The sanitary sewers lift stations were constructed at various stages of development between 1970 and 2022. Proposed Capital Improvements Plan (“CIP”) projects over the next 10 years include rehabilitation and replacement of piping and pumps (such as recoating to prolong the useful life and prevent corrosion); and other site improvements and inspections.

Storm Sewer and Detention Pond Maintenance:

The District maintains 14 detention ponds and 1 drainage channel (M102-00-00 north of West Rayford Road). M102 drainage channel is jointly maintained with Oakmont PUD via a 50/50 split. Proposed Capital Improvements Plan (“CIP”) projects over the next 10 years include desilting of ponds and channels, and repairs to storm sewer outfall pipes.

- What is Northampton MUD?

Northampton MUD (the “District”) is a political subdivision of the state of Texas created to provide its residents with potable water, sanitary sewer, and stormwater detention and drainage services. Additionally, the District has the ability to finance, operate, and maintain recreational facilities. The District encompasses approximately 1,654 total acres of land and serves approximately 2,363 single-family lots, several multi-family properties, commercial retail properties and four Klein ISD schools. On August 20, 2012, the District took action to proceed with the creation of a Defined Area encompassing approximately 439.69 acres within the District (Hampton Creek), which was confirmed by the District voters at an election on November 6, 2012. - What water, sanitary sewer, and drainage facilities serve the District?

The District’s existing water supply system consists of 3 water plants including 3 water wells. The District’s wastewater treatment system consists of a 1,400,000 gallon per day (“gpd”) treatment plant, which it owns jointly with Oakmont PUD, and seven lift stations. All of the storm sewer outfalls drain into Harris County Flood Control ditches that ultimately outfall into Willow Creek or Spring Creek. The District also owns and maintains various stormwater detention ponds throughout the District. - What is bond authorization?

A bond authorization is an authorization to sell bonds to fund District projects. It is similar to a line of credit that a business might use to fund its operations. An authorization is NOT immediate funding, nor is it a “blank check” to fund the entire amount of the authorization without meeting strict regulatory requirements imposed and regulated by the Texas Commission on Environmental Quality (TCEQ). Once the need for a District project arises and it is determined the project financially feasible to fund with Bonds, the District will prepare a Bond Application Report and submit to the TCEQ for approval prior to advertisement and sale of the Bonds. Typically, when the District sells bonds to fund capital projects, they will sell bonds for projects upcoming within the next 2 to 3 years, which is most cost effective for the District. While an authorization may be for a large amount, bonds may only be sold with TCEQ approval at the time projects are ready to begin or as needed for capital improvements or replacement. - What will be voted on at the District’s May 2024 election?

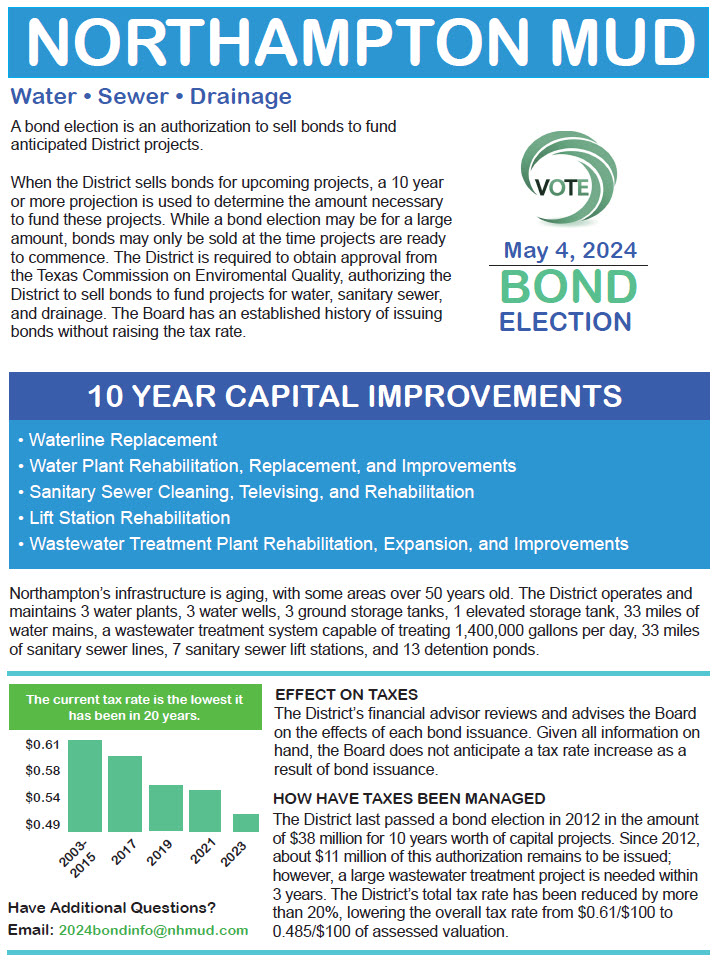

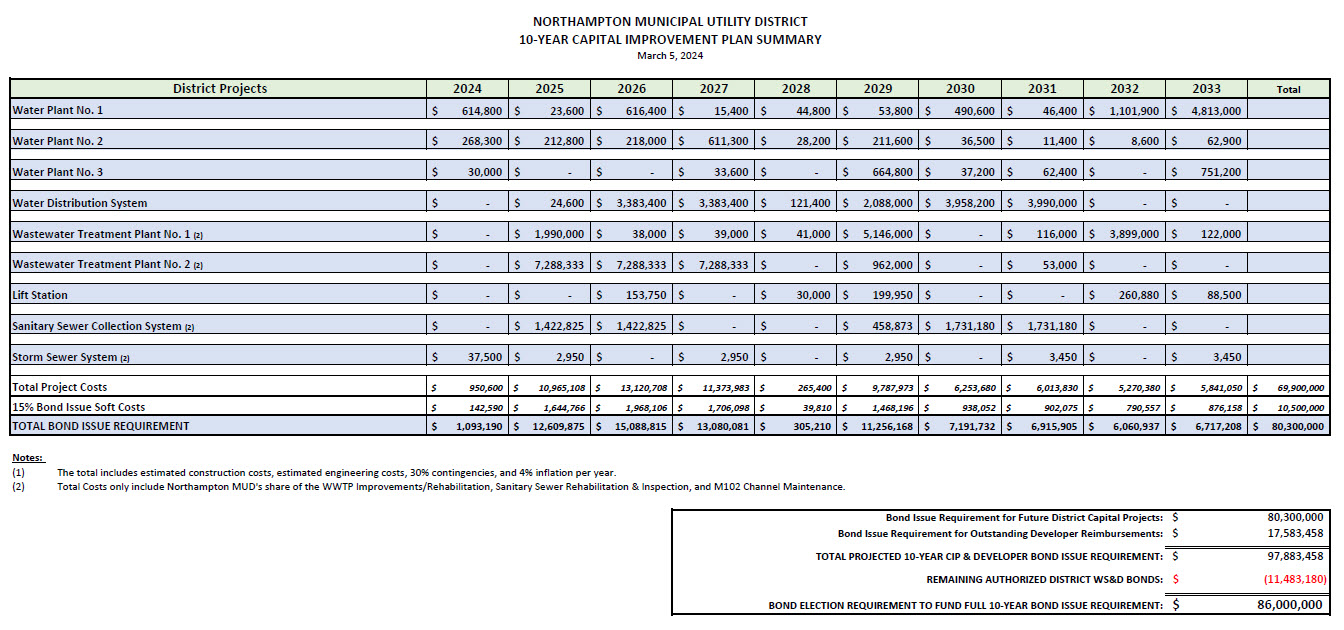

The District is seeking approval of $86,000,000 in water, sewer, and drainage bonds (PROP A) to fund capital improvements to the utility system over the next 10 years. This will also allow the District to refund these bonds (reissue at lower interest rates) at a future date.Refunding bonds allow the District to “refinance” their outstanding debts at a lower interest rate, to reduce the amount of future bond payments, and to save money on bond debt. The time period of the bond payments will not be extended, solely refinanced at a lower interest rate to save the District money, similar to a homeowner refinancing their mortgage.The following propositions will be presented to the voters of the District asking voters to select one option of either FOR or AGAINST.PROPOSITION ATHE AUTHORITY OF THE DISTRICT TO ISSUE $86,000,000 OF FUTURE BONDS, FOR THE PURPOSE OF MAKING REPAIRS, REPLACEMENTS, AND ADDITIONS TO THE DISTRICT’S EXISTING WATERWORKS SYSTEM, SANITARY SEWER SYSTEM, AND DRAINAGE AND STORM SEWER SYSTEM OR PURCHASING, ACQUIRING AND CONSTRUCTING FURTHER WORKS, IMPROVEMENTS, FACILITIES, EQUIPMENT AND APPURTENANCES FOR SAID SYSTEMS, AND FOR THE PURPOSE OF REFUNDING SUCH BONDS, AND THE LEVY OF AD VALOREM TAXES SUFFICIENT TO PROVIDE FOR THE PAYMENT OF PRINCIPAL AND INTEREST ON THE BONDS, AND THE ISSUANCE OF BONDS. - How will bond authorization affect my taxes?

Because bonds may not be issued without Board approval, bond authorization alone will have no effect on your taxes. At this time, given all information on hand as shown in the Bond Election Report, the Board does not anticipate a total tax rate increase as a result of bond issuance for water, sewer, and drainage projects, or development reimbursements over the next 10 years. - How are my taxes determined?

The District levies an overall tax rate comprised of two components: (1) debt service tax, which may be used only to make payments on the District’s outstanding bonds; and (2) maintenance and operations tax, the proceeds of which are used in conjunction with water and sewer revenue to pay operating and maintenance expenses of the District. Currently, of the $.485/$100 tax rate, $0.235 is designated for debt service, and the remaining $0.25/$100 is for maintenance and operations. - How have my taxes been managed?

Since bonds were last approved by voters in 2012, the Board has reduced the District’s total tax rate by more than 20%, lowering the overall tax rate from $0.61/$100 of assessed valuation to $0.485/$100 of assessed valuation. - How much bond authorization does the District have?

The District currently has $11,483,180 in remaining bond authorization from the 2012 bond election. When the voters authorized a total of $36,000,000 for the purpose of constructing water, sanitary sewer, and drainage facilities, $28,970,000 of the bonds authorized in the 2012 election were issued between 2015 and 2021 in five (5) bond issuances to water, sanitary sewer, and drainage infrastructure in the District. Additionally, since 2010, as a result of prudent financial oversight by the Board, the District has managed its annual debt service expenses by refinancing bonds at lower interest rates and generating approximately $1,782,468.96 in gross debt service savings through the issuance of refunding bonds. According to the District’s Engineer, the District’s remaining $11,483,180 of bond authorization will not be sufficient to address the anticipated projects over the next 10 years, in addition to the development of existing and future property within the District. - What will bond authorization be used for?

The Bond Election Report prepared by the District’s Engineer identifies the projects the Board anticipates will be necessary over the next 10 years to maintain, replace, or upgrade the aging water and wastewater infrastructure owned and operated by the District. As a proactive measure, the Bond Election Report outlines the potential cost for those projects (and required bond issuance costs), considering all information available today. The District Engineer prepares a Capital Improvements Plan outlining these projects and updates it annually. - How are the projects proposed in the Capital Improvements Plan (“CIP”) determined?

Various factors are considered in preparation of the CIP. The District performs annual inspections of the Water Plant facilities (as required by TCEQ), and inspections of the WWTP approximately every 3 years (or as needed). The District’s engineer reviews the condition of the facilities through the inspections, receives input from the District’s operator who operates the facilities daily, and uses industry standards for useful life of the facilities/equipment to estimate when a project (repair, recoat, maintenance, or replacement) may be needed. The CIP is not a set schedule for maintenance and is continually updated annually. Projects included on the CIP could move sooner or later depending on their condition. Each project is reassessed every year and prior to entering into design. - What is the primary alternative to funding projects with bond monies?

The primary alternative to authorizing the bonds is to fund all necessary projects on a “pay as you go” basis, which would require increasing the District’s maintenance tax rates and/or water and sanitary sewer rates. The District must have funds in hand for a project prior to entering into construction, as required by the TCEQ. Funding projects with maintenance taxes or water and sewer rates would likely require an increase in rates in the short-term in order to collect the required funds. This method places the financial burden for long term projects on current residents for projects whose useful life would benefit future residents of the District and could create delays and increase costs for the completion of projects.Authorizing the District to issue additional bonds through the bond election, will allow the Board to spread the costs of the projects over numerous years and avoid the increases in maintenance tax rates and/or water and sanitary sewer rates typically required by a “pay as you go” approach. This method spreads the cost for these projects among both current and future residents and businesses in the District via their debt service tax rates. This also enables the District to complete projects quickly and efficiently rather than generating the revenue via “pay as you go.”

Open Houses

March 26th, April 23rd

6 pm – 8 pm,

@ Northampton Community Center

Early Voting

April 22nd – 26th, April 29th – 30th

8 am – 5 pm

@ Northampton MUD Office Building

6012 Root Road, Spring, TX 77389

Election Day

May 4th

7 am – 7 pm

@ Northampton MUD Office Building

6012 Root Road, Spring, TX 77389

Mail in Ballot

- Deadline for Regular Mail In Ballots: Before the polls close on Election Day.

- Deadline for Overseas Ballots: Last mail delivery on the fifth day after Election Day.

- Deadline for Military Ballots: Last mail delivery on the sixth day after Election Day.

*NOTE: Harris County Election may be held separately at the Northampton MUD Community Center.